Auto Body Shop Parts Insurance protects inventory, tools and equipment against damage, loss, and liability during collision repairs, ensuring businesses can provide quality services with OEM-standard replacements covered by extended warranties. Understanding claims process is crucial for smooth post-damage car repair.

Insurance Coverage for Auto Body Shop Parts: A Comprehensive Guide

Navigating the complex world of auto repairs can be challenging, especially when it comes to ensuring quality replacement parts. This guide delves into the essential aspects of insurance coverage specifically tailored for auto body shop parts. Understanding these policies is crucial for both businesses and consumers, as it guarantees the use of genuine, guaranteed components during restoration processes. By exploring types of coverage and claims procedures, you’ll gain valuable insights into safeguarding your vehicle’s repair journey.

- Understanding Auto Body Shop Parts Insurance

- Types of Coverage for Replacement Parts

- Claims Process and Common Considerations

Understanding Auto Body Shop Parts Insurance

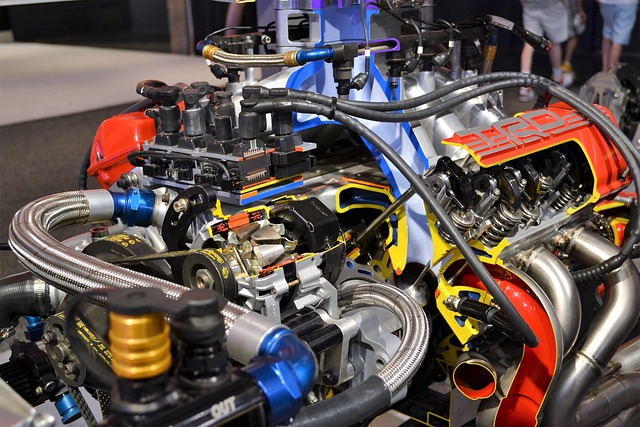

Auto Body Shop Parts Insurance is a specialized form of coverage designed to protect the inventory and assets of auto body shops. These businesses, which often invest significantly in parts and equipment, need insurance that caters to the unique risks they face. Collision repairs, for instance, involve working with fragile and valuable components, making it crucial to have insurance that covers these parts against damage, theft, or loss.

Understanding this type of insurance is essential for auto body shop owners and managers. It goes beyond traditional property coverage by providing specific protection for the various auto body shop parts they acquire and use in their operations. This includes everything from metal sheets and paint to specialized tools and diagnostic equipment. By insuring these assets, businesses can safeguard against financial losses that could significantly impact their ability to provide services, such as auto body repair or collision repairs, at their facility, conveniently located for many customers seeking a reliable auto repair near me.

Types of Coverage for Replacement Parts

When it comes to insuring auto body shop parts, several types of coverage options are available. The primary goal is to ensure that replacement parts are of the same quality as the original equipment manufacturer (OEM) parts, maintaining the car’s safety and performance standards. One common type of coverage is automotive body shop-specific insurance, which protects against losses incurred during the procurement and installation of parts. This includes liability for damaged or incorrect parts, ensuring that the car body shop can replace them without additional financial burden.

Additionally, extended warranty programs are offered by many insurance providers, covering replacement parts beyond the standard manufacturer’s warranty. These programs safeguard against unforeseen issues with newly installed components, providing peace of mind for both auto body shop owners and customers. Such coverage is particularly beneficial for high-wear areas or complex car bodywork repairs, ensuring that any potential problems are addressed promptly and without significant cost to the vehicle owner.

Claims Process and Common Considerations

When your car suffers damage, understanding the claims process for auto body shop parts is crucial. The first step involves assessing the extent of the damage to your vehicle’s bodywork and determining which parts need replacement or repair. This can often be done by a professional mechanic or an insurance adjuster. Once the damages are agreed upon, you’ll file a claim with your insurance provider. They will then issue a payout for the cost of replacing or repairing these damaged auto body shop parts.

Common considerations during this process include understanding your deductible—the amount you’re responsible for paying out of pocket before insurance coverage kicks in—and knowing which parts are covered under your specific policy. Some policies may have limitations on the quality or brand of replacement parts, while others might offer more flexibility. It’s also essential to keep records of all estimates and receipts related to the repair work to ensure a smooth claims process for your vehicle bodywork.

Auto body shop parts insurance is a vital safety net for businesses, ensuring they have access to quality replacement components. By understanding the various coverage types and streamlining the claims process, shops can provide efficient service while protecting their investments. This comprehensive guide has shed light on these crucial aspects, empowering auto body shops to make informed decisions regarding their inventory management and financial security.